daixu.site Learn

Learn

Direxion Retail Bear Etf

Find the latest quotes for Direxion Daily Retail Bull 3X Shares (RETL) as well as ETF details, charts and news at daixu.site For more information about a particular Retail - Leveraged ETF, click on the fund name. Retail - Leveraged ETFs. • RETL - Direxion Daily Retail Bull 3X Shares. Explore Direxion's leveraged and inverse and non-leveraged ETFs. Find the ETFs to meet your investment goals. SUMMARY OF DIREXIONSHARES. 1. DIREXION DAILY RETAIL BULL 2X SHARES. 1. DIREXION DAILY RETAIL BEAR 2X SHARES. 7. DIREXION DAILY BASIC MATERIALS BULL 3X SHARES. Exchange Traded Notes (ETNs) are distinct from Exchange Traded Funds (ETFs). ETNs are debt instruments backed by the credit of the issuer and as such bear. ProShares UltraPro S&P $ UPRO % ; Direxion Daily Semiconductor Bull 3X Shares. $ SOXL % ; SPDR S&P Retail ETF. $ XRT %. Unlock your trading potential with Direxion - The trusted leader in Leveraged and Inverse ETFs. Discover more opportunities today! Learn everything you need to know about Direxion Daily Retail Bull 3X ETF (RETL) and how it ranks compared to other funds. Research performance, expense. Direxion Daily Retail Bear 3X Shares (NYSE:RETS) institutional ownership structure shows current positions in the company by institutions and funds, as well as. Find the latest quotes for Direxion Daily Retail Bull 3X Shares (RETL) as well as ETF details, charts and news at daixu.site For more information about a particular Retail - Leveraged ETF, click on the fund name. Retail - Leveraged ETFs. • RETL - Direxion Daily Retail Bull 3X Shares. Explore Direxion's leveraged and inverse and non-leveraged ETFs. Find the ETFs to meet your investment goals. SUMMARY OF DIREXIONSHARES. 1. DIREXION DAILY RETAIL BULL 2X SHARES. 1. DIREXION DAILY RETAIL BEAR 2X SHARES. 7. DIREXION DAILY BASIC MATERIALS BULL 3X SHARES. Exchange Traded Notes (ETNs) are distinct from Exchange Traded Funds (ETFs). ETNs are debt instruments backed by the credit of the issuer and as such bear. ProShares UltraPro S&P $ UPRO % ; Direxion Daily Semiconductor Bull 3X Shares. $ SOXL % ; SPDR S&P Retail ETF. $ XRT %. Unlock your trading potential with Direxion - The trusted leader in Leveraged and Inverse ETFs. Discover more opportunities today! Learn everything you need to know about Direxion Daily Retail Bull 3X ETF (RETL) and how it ranks compared to other funds. Research performance, expense. Direxion Daily Retail Bear 3X Shares (NYSE:RETS) institutional ownership structure shows current positions in the company by institutions and funds, as well as.

RETL profile. The Direxion Daily Retail Bull 3X Shares (USD) is a(n) Equity Exchange Traded Funds (ETF) seeks to invest in Retail. A high-level overview of Direxion Daily Retail Bull 3X Shares ETF (RETL) stock. Stay up to date on the latest stock price, chart, news, analysis. Direxion Dly Retail Bull 3x share price live: RETL Live stock price with charts, valuation, financials, price target & latest insights. Direxion Shares ETF Trust, Fixed Transaction Fee, Maximum Additional Charge Direxion Daily Retail Bear 3X Shares, N/A, N/A, $, Up to %, Up to Find the latest Direxion Daily Retail Bear 3X S (RETS) stock quote, history, news and other vital information to help you with your stock trading and. Positive Retail Data Brings Direxion Amazon-Focused ETFs AMZU And AMZD Into The Spotlight Leveraged And Inverse Single Stock ETFs Can Help You Maximize. Get detailed information about the Direxion Daily Retail Bull 3X Shares ETF including Price, Charts, Technical Analysis, Historical data, Direxion Daily. This ETF offers 2x daily long leverage to the Russell RGS Retail Index, making it a powerful tool for investors with a bullish short-term outlook for. Click to see more information on Leveraged 3X Inverse/Short ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. ETF strategy - DIREXION DAILY DOW JONES INTERNET BEAR 3X SHARES - Current price data, news, charts and performance. The fund invests at least 80% of its net assets in financial instruments, such as swap agreements, securities of the index, and ETFs that track the index. *Unlike traditional ETFs, or even other leveraged or inverse ETFs, these leveraged or inverse single-stock ETFs track the price of a single stock rather. 85 ETFs ; HIBL, Direxion Daily S&P High Beta Bull 3X Shares, M ; RETL, Direxion Daily Retail Bull 3x Shares, M ; TSLS, Direxion Daily TSLA Bear 1X. Latest Direxion Daily Retail Bull 3X Shares News: View RETL news and discuss market sentiment with the investor community on daixu.site International Equity. MSCI Emerging Markets Index (NDUEEGF). EDC. Daily MSCI Emerging Markets Bull 3X Shares. %. EDZ. Daily MSCI Emerging Markets Bear 3X. Explore RETL for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. What's Inside Direxion Leveraged and Inverse ETFs · What's Inside TECL/TECS - Direxion's Daily Technology Bull and Bear 3X Shares ETFs? Direxion ETFs. Direxion Retail Bull ETF Rallies As GameStop Traders Look For Diversification To Play The Stock's Surge. Direxion QQQU & QQQD: 2x Leveraged & -1x Inverse ETFs on Leading Nasdaq Stocks. Amplify or hedge your daily returns on the top holdings of the Nasdaq. Real time Direxion Shares ETF Trust - Direxion Daily Retail Bull 3x Shares (RETL) stock price quote, stock graph, news & analysis.

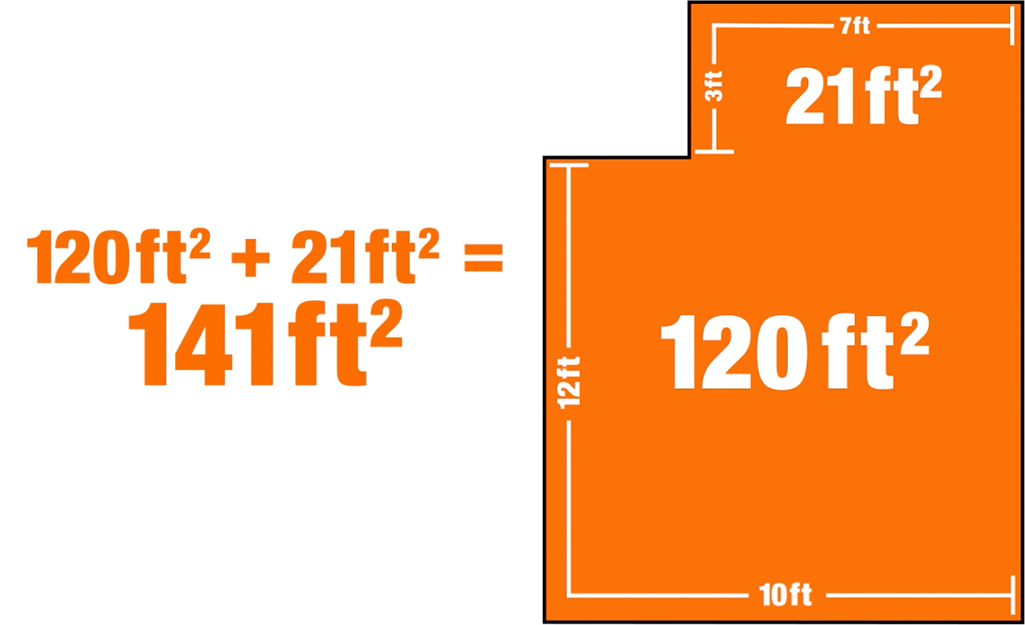

How To Calculate House Square Feet

If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. Multiply the length in feet by To convert square feet into square meters, multiply your SF number by feet and meters conversion. How to find square feet: multiply the length measurement in feet by the width measurement (in feet). This yields a product called the area, which is expressed. Divide 80 by , which gives you You can estimate your square footage to be square feet. Why Is the Actual Square Footage Different From What Is. Multiply Length by Width: Once you have the measurements, multiply the length of the room by its width. The result is the area of the room in square feet. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . You calculate square footage by measuring the length and width, of each room. Then, multiply the length by the width to calculate that room's square footage. A house plan's total square footage tells you how many square feet of finished space a plan offers. The finished space is the heated living area of the house. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two. Multiply the length in feet by To convert square feet into square meters, multiply your SF number by feet and meters conversion. How to find square feet: multiply the length measurement in feet by the width measurement (in feet). This yields a product called the area, which is expressed. Divide 80 by , which gives you You can estimate your square footage to be square feet. Why Is the Actual Square Footage Different From What Is. Multiply Length by Width: Once you have the measurements, multiply the length of the room by its width. The result is the area of the room in square feet. If the ceiling is angled, it must be 7 feet or higher for at least half of the room's floor area. If it is, then any part of the room with a ceiling of 5 feet . You calculate square footage by measuring the length and width, of each room. Then, multiply the length by the width to calculate that room's square footage. A house plan's total square footage tells you how many square feet of finished space a plan offers. The finished space is the heated living area of the house. If your house is a perfect rectangle then you can roughly calculate the square footage by measuring the width and length of the house and multiplying the two.

For example, to calculate the square footage using measurements in inches or another measurement, first convert the length and width measurements to feet by. If there's a part of your house that's shaped like a half of a circle, you can find the square footage of the circle by finding the area of the space as if it. Then subtract from this total the square footage of the house footprint, driveway, To determine the square footage of some familiar shapes. SQUARE or. If a house is 1, square feet, then there are 1, “units” that measure 12 inches by 12 inches. Square footage is used to determine the amount of. Then, for each room, you measure the length and the width in feet. Multiply these two numbers together and you have the square footage of that room. Now, let's. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. Price per square foot can be calculated by taking the figure for property price or monthly rental and dividing it by the total square footage of the living. You just multiply the length of a room or house in feet by the width in feet. calculate the square footage of the entire home in one equation by measuring. If the house has a full dormer, estimated square footage of the dwelling as a 1 ¾-story house. If in doubt, measure the square-foot area of the second floor. So how can you determine the square footage of your exterior log walls. House B. House C. 20'. 44'. 45'. Floor Area = sq. ft. Perimeter = 44+44+45+. To calculate square footage, all of your measurements need to be in feet. If you recorded the length and width in inches, you can easily convert them to feet. You will multiply the foot width by the foot length to find the square footage of your room which is square feet. 12 ft x 12 ft = ft². Converting. in width, you would multiply the two figures ( x ) to determine the square footage, which equals square feet. Step 4. If the room or area you. The finished square footage of each level is the sum of the finished areas on that level measured at floor level to the exterior finished surface of the. You just multiply the length of a room or house in feet by the width in feet. calculate the square footage of the entire home in one equation by measuring. Measure wall height from floor to ceiling. Exclude baseboards and moldings. Measure length of each wall including doors and windows. Find the total square feet. Multiply your house length by your house width to get the area. (For example, 40 feet x 30 feet = 1, square feet.) Next, multiply the area by your roof's. Walk the length of your lawn, figuring that one pace equals about 3 feet. Do the same with the width of the lawn. · Then multiply the length by the width to. To convert your square inches measurement to feet, divide by calculating the square footage Calculating the sq ft. How do I figure our square feet from. You'll also want to be sure to measure through doorways to get an accurate measurement. Then use the square footage calculator to add the footage of each space.

Places That Add Money To Cash App

Use it for Payments, Banking, Investing, the Cash App Card, and offers. Payments. Send and receive money with anyone, donate to an important cause, or tip. The Cash App Card isn't connected to your personal debit card or bank account. Cashing Out transfers your funds from your Cash App balance to your debit card or. Where Can I Load My Cash Card · 1. Dollar General · 2. Family Dollar · 3. GoMart · 4. H-E-B · 5. Kum & Go · 6. Kwik Trip · 7. Pilot Travel Center · 8. Rite Aid. Don't have your card? You can still deposit cash at your local CVS Pharmacy®, RiteAid, Walgreens®, and Walmart by using the GO2bank app. Just. Lili customers can deposit cash into their Lili account at over 90, retail locations (such as many of the following stores: Walmart, CVS, Walgreens, 7-Eleven. Cash App Pay is currently available for businesses processing payments on Square Register, Square Stand, and Square Terminal, as well as Square Point of Sale. Load money onto your card at Walgreens, Walmart, Dollar General, Rite Aid, 7-Eleven, or CVS (may be charged a $4 fee). Ask the cashier to do a Cash App deposit. Offers let you save money instantly when you use your Cash App Card at coffee shops, restaurants, and other merchants. Simply provide your Cash App card to the cashier and ask them to load the desired amount of cash onto your card. K views ·. View upvotes. Use it for Payments, Banking, Investing, the Cash App Card, and offers. Payments. Send and receive money with anyone, donate to an important cause, or tip. The Cash App Card isn't connected to your personal debit card or bank account. Cashing Out transfers your funds from your Cash App balance to your debit card or. Where Can I Load My Cash Card · 1. Dollar General · 2. Family Dollar · 3. GoMart · 4. H-E-B · 5. Kum & Go · 6. Kwik Trip · 7. Pilot Travel Center · 8. Rite Aid. Don't have your card? You can still deposit cash at your local CVS Pharmacy®, RiteAid, Walgreens®, and Walmart by using the GO2bank app. Just. Lili customers can deposit cash into their Lili account at over 90, retail locations (such as many of the following stores: Walmart, CVS, Walgreens, 7-Eleven. Cash App Pay is currently available for businesses processing payments on Square Register, Square Stand, and Square Terminal, as well as Square Point of Sale. Load money onto your card at Walgreens, Walmart, Dollar General, Rite Aid, 7-Eleven, or CVS (may be charged a $4 fee). Ask the cashier to do a Cash App deposit. Offers let you save money instantly when you use your Cash App Card at coffee shops, restaurants, and other merchants. Simply provide your Cash App card to the cashier and ask them to load the desired amount of cash onto your card. K views ·. View upvotes.

Easily deposit cash using the Green Dot app at any participating location nationwide. Check the Green Dot app to find a location near you. You can add as much as $ or as little as $ Just give the amount of cash you wish to add to the cashier, swipe your card and your money is immediately. Open the MAJORITY app and choose “Add Money”. · Select “Cash deposit”. · Tap “Show locations” if they're not already on the screen. · Use the map to find a. To find a location near you, in your app click Move Money > Deposit cash > Show deposit locations. Your cash deposit will be available as soon as Green Dot. Cash App has partnered with various retail stores where you can add cash to your account. Some popular options include Walmart, Walgreens, 7-Eleven, and CVS. Add cash to your Target Circle Card Reloadable Account for free at any Target location, or at thousands of other participating retailers. Cash App is the easy way to send, spend, save, and invest* your money Being able to load money from a bunch of places for $1, no atm fees if you. locations nationwide, and funds will be available in your Found account in seconds. To deposit cash, select Add Money in your Found app and choose “Cash. Add Cash in Store. Add cash to your Checking account at any CVS®, Walgreens® or Duane Reade by Walgreens® location. Sign in to add money. FREQUENTLY ASKED. Walmart (Customer Service Desk/ Money Centers) · Walgreens · Duane Reade · 7-Eleven · Family Dollar · GoMart · Sheetz · Kum & Go. Bring your debit card and cash to a participating merchant like Walmart, CVS, 7-Eleven, Walgreens. Tell the clerk you'd like to load cash ($20 minimum) to your. Then you'll be able to withdraw money from your Google Pay balance to your Cash App debit card. Step 1: Add your Cash App Card to Google Wallet. Launch Cash App. Deposit at selected ATMs. · How to Add Money with a Barcode in the MyBambu App · Download MyBambu App. · Tap the add cash button · Search for Stores · Barcode · Scan. Add money1. Direct Deposit. Receive all or Pay bills or write a Check and cash it at thousands of participating surcharge-free6 check cashing locations. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Funds - You can add funds to your account directly at the register at Dollar General locations or at thousands of participating retailer locations. Just give. Take your cash and phone to any of the listed retail locations near you. Open your Chime app and go to the Move Money page. Tap Deposit Cash to view your. Add cash to your PayPal account and turn dollar bills into digital currency. Just deposit money to your account, shop, and be on your way. If you don't have your physical card, you can deposit cash using your One app-generated barcode at any Money Center or Customer Service Desk at Walmart. These.

Rally Alternative Investments

Rally is a New York-based platform that offers investors the opportunity to buy and sell equity shares in collectible assets. equity investments to users of all income levels. The mission: to democratize alternative asset investing by providing access, liquidity and transparency to. See how Rally compares to similar products. Rally's top competitors include Securitize, Equi, and YieldStreet. Listen to this episode from Alt Goes Mainstream: The Latest on Alternative Investments, WealthTech, & Private Markets on Spotify. Home» Financial Advisor» FA Online» Channels» INVESTMENT MANAGEMENT» Alternative Investments Gold's record-setting rally above $2, an ounce looks to. Rally is a platform for buying and selling equity shares in collectible assets, enabling anyone to invest in one-of-a-kind collectibles. r/rallyrd: Community for Rally Rd investors. Rally Rd. is a platform for buying & selling equity shares in collectible assets with ease. The alternative asset class backed by data. Making confident investment decisions starts with high-quality research. Given that Art is one of the world's oldest. Rally is a trading platform that lets you buy and sell equity shares in collectibles. So instead of swapping shares of AAPL or VOO, you're swapping shares of. Rally is a New York-based platform that offers investors the opportunity to buy and sell equity shares in collectible assets. equity investments to users of all income levels. The mission: to democratize alternative asset investing by providing access, liquidity and transparency to. See how Rally compares to similar products. Rally's top competitors include Securitize, Equi, and YieldStreet. Listen to this episode from Alt Goes Mainstream: The Latest on Alternative Investments, WealthTech, & Private Markets on Spotify. Home» Financial Advisor» FA Online» Channels» INVESTMENT MANAGEMENT» Alternative Investments Gold's record-setting rally above $2, an ounce looks to. Rally is a platform for buying and selling equity shares in collectible assets, enabling anyone to invest in one-of-a-kind collectibles. r/rallyrd: Community for Rally Rd investors. Rally Rd. is a platform for buying & selling equity shares in collectible assets with ease. The alternative asset class backed by data. Making confident investment decisions starts with high-quality research. Given that Art is one of the world's oldest. Rally is a trading platform that lets you buy and sell equity shares in collectibles. So instead of swapping shares of AAPL or VOO, you're swapping shares of.

Rally offers a platform specializing in alternative asset investment, offering a marketplace for buying and selling equity shares in collectible assets. Rally careers. image. Buy & Sell shares in alternative assets, just like stocks. Rally Rd. is a first-of-its-kind platform where unique, high-value assets. The company's platform democratizes alternative asset investing allowing fractional buying and selling of equity shares in collectible assets, providing. It's time to rebuild 60/40 portfolios with alternative sources of diversification and return. Learn how alternative investments create more resilient. Rally is a platform for buying & selling equity shares in collectible assets. Together, we rally to make investing behind ideas, emotions, and communities safe. Others, like Royalty Exchange and Rally, have opened new models to invest across music royalties and collectibles. assets in alternative investments. assets such as real estate and intellectual property. How Rally makes money. Rally's fees reflect their goal to democratize the alternative asset market. In. The Rally Gift Card is the perfect way to start any investor on a pathway to Alternative Asset investing. Investing in Local Businesses with Republic| Republic Investment Platform. Dow's Stock Talk · My Rally Rd Investing Portfolio| Rally Rd. Rally they provide equity shares in collectible assets. They make investing in ideas, emotions, and communities safe, easy, and accessible. I first heard of Rally years ago from this magazine and they just mentioned fractional investing in alternative assets again this week. assets are securitized, split into shares, then offered as equity investments to Find out more about Rally Rd., alternative asset classes, App. Rally Rd. is similar to Collectable, except it has a much wider variety of assets you can invest in. This includes rare collectables like comic books, luxury. Alternative Investments. Collectibles are a great way to diversify your portfolio. Rally gives you access to a wide range of collectibles, including artwork. Sharesight, a popular investment portfolio tracker, is used in more than countries around the world. It tracks all your stocks, ETFs and dividends in one. Founded with the mission to make alternative investments accessible, Rally allows individuals to invest in a range of collectibles from classic cars and. Alternative investments can help with portfolio diversification as well as provide inflation protection. Technology and healthcare stocks should rally. Slice Capital allows anyone to invest in startups. Our equity crowdfunding platform provides quality alternative investment opportunities in a sleek and. “Alternative Investments” include certain publicly or non-publicly traded alternative investment assets If Alternative Investments are purchased through Rally.

If You Have Overdraft Protection

Sign up for Overdraft Protection and link your Wells Fargo credit card to your Wells Fargo personal checking accountFootnote 1. Then, if you happen to spend. Overdraft Protection helps cover your purchases and kicks in when an eligible transaction brings your available Debit balance below $0. When you become a Plus. Overdraft protection is a guarantee that a check, ATM, wire transfer, or debit-card transaction will clear if the account balance falls below zero. There may be. You'll never be charged an overdraft fee from everyday debit or ATM⁵ card transactions. What's the disadvantage? If you don't have enough money to cover a debit. For Chase Sapphire℠ Checking and Chase Private Client Checking℠ accounts, there are no Overdraft Fees when item(s) are presented against an account with. You can protect yourself from unexpected overdrafts by enrolling in Overdraft Protection, which enables automatic transfers to your checking account if your. With overdraft protection, funds from the linked accounts you designate are transferred automatically into your checking account to cover overdrafts. If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. Regions Overdraft Protection may be used to pay checks, ACH transactions, and other items when payment of those items would overdraw the checking account. Sign up for Overdraft Protection and link your Wells Fargo credit card to your Wells Fargo personal checking accountFootnote 1. Then, if you happen to spend. Overdraft Protection helps cover your purchases and kicks in when an eligible transaction brings your available Debit balance below $0. When you become a Plus. Overdraft protection is a guarantee that a check, ATM, wire transfer, or debit-card transaction will clear if the account balance falls below zero. There may be. You'll never be charged an overdraft fee from everyday debit or ATM⁵ card transactions. What's the disadvantage? If you don't have enough money to cover a debit. For Chase Sapphire℠ Checking and Chase Private Client Checking℠ accounts, there are no Overdraft Fees when item(s) are presented against an account with. You can protect yourself from unexpected overdrafts by enrolling in Overdraft Protection, which enables automatic transfers to your checking account if your. With overdraft protection, funds from the linked accounts you designate are transferred automatically into your checking account to cover overdrafts. If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. Regions Overdraft Protection may be used to pay checks, ACH transactions, and other items when payment of those items would overdraw the checking account.

Optional Overdraft Protection Service (OOPS) · $20 fee for each overdraft per account · No fee on transactions of $5 or less, or if your total overdrawn balance. Overdraft Protection Programs · What is overdraft protection? · How can my account be overdrawn when I just made a deposit? · I received notice from my bank that. We make overdraft fees avoidable. With our $50 Safety Zone®, there is no fee if your account is overdrawn by $50 or less. An overdraft fee can occur if the dollar amount of your transaction is more than the amount of money available in your account. If Think pays for the item. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. As noted above, with Savings Overdraft Protection, automatic transfers are made from your savings or money market account to your checking account if it becomes. If you overdraw your account with a transaction of $5 or less or the overdrawn balance is $5 or less, we will not charge an Overdraft Fee. Checking and money. If your account is overdrawn by less than $, a reduced Overdraft Charge of $ will be assessed per overdrawn item. A $ Consumer Negative Balance Fee. Overdraft Assistance for Your Personal Accounts · A fee is not charged for a returned item when there are insufficient funds in your account · There is no charge. An overdraft fee ($35) is the cost of using our discretionary overdraft services when you need additional funds to cover a transaction. If you're about to overdraw your account, we'll automatically transfer available funds from your linked backup account. If you've linked multiple backup. Your checking account is overdrawn when there's not enough money to cover a payment, purchase or check you write. We may pay overdraft transactions at our. If your account is overdrawn by less than $, a reduced Overdraft Charge of $ will be assessed per overdrawn item. A $ Consumer Negative Balance Fee. Overdraft Assistance for Your Personal Accounts · A fee is not charged for a returned item when there are insufficient funds in your account · There is no charge. If you overdraw your checking account, the bank can pull funds from your savings to cover the shortage, as long as you have enough funds available. Your bank. If we elect to pay an overdraft item, you have no right to defer payment and you must deposit additional funds into your account promptly in an amount. How much additional time do I have to avoid an Overdraft Fee? You only need to add money to cover your overdrawn balance if each item overdrawing your account. Opting in to Overdraft Coverage allows PNC to cover your ATM and everyday (one-time) debit card transactions when your available balance is not enough to cover. We make overdraft fees avoidable. With our $50 Safety Zone®, there is no fee if your account is overdrawn by $50 or less.

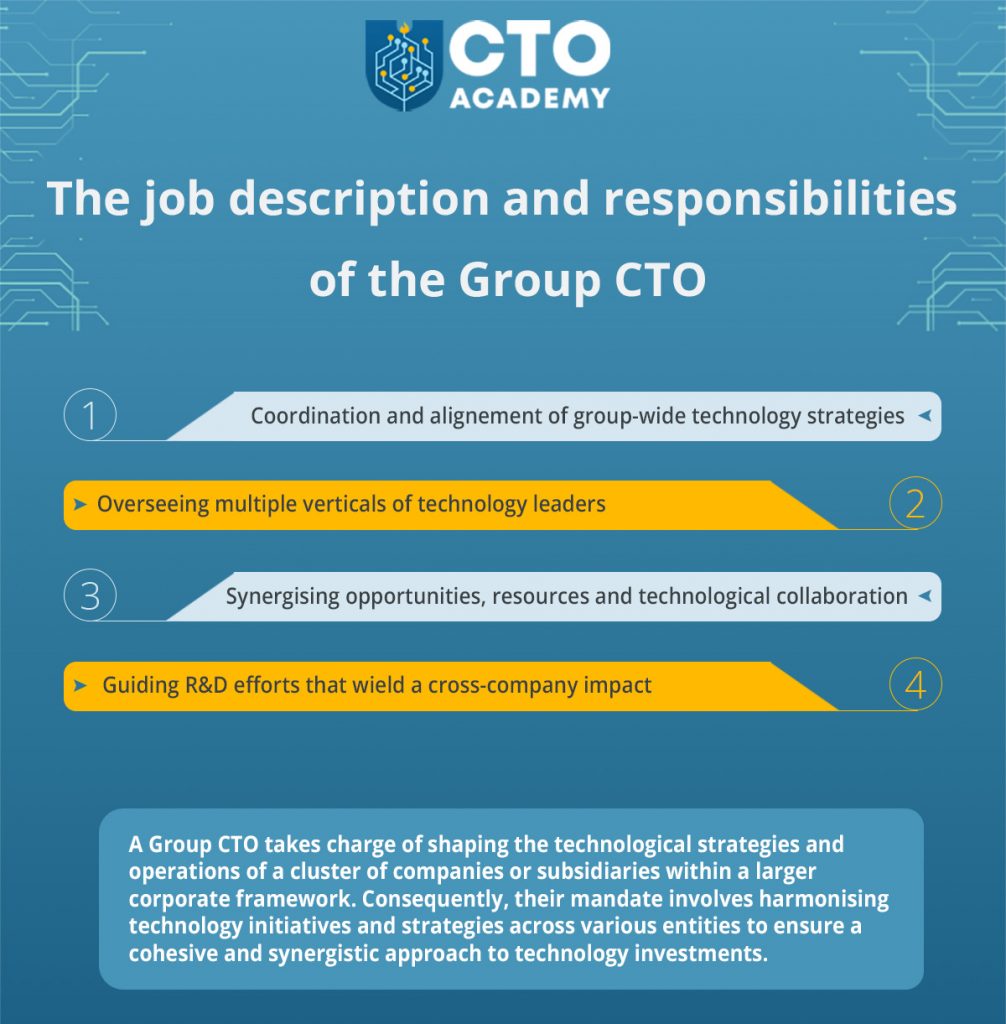

Duties Of A Cto

Build your own Chief Technology Officer (CTO) job description using our guide on the top skills, education, experience and more. Post your job today. The CTO will also be responsible for developing and maintaining relationships with vendors, partners, and customers. This includes developing contracts. The CTO is often in charge of research and development, product engineering, and formulating the technical architecture on which the whole company will be built. The role of a CTO in a startup company is multi-faceted and involves several key tasks and responsibilities such as hiring engineers, developing a. This role will help enable communication, collaboration, strategy execution, and special projects across the CTO organization. The responsibilities include both. A skilled CTO frequently serves as the oracle of technology. They find cutting-edge technological solutions and offer innovative ideas to the business. The chief technology officer (CTO) is the person in a company who deals with innovation and makes effective technology strategies. A CTO is a senior-level “lead technologist” of a company who is responsible for creating, executing and implementing the organization's. We are looking for a Chief Technology Officer (CTO) to provide sound technical leadership in all aspects of our business. Build your own Chief Technology Officer (CTO) job description using our guide on the top skills, education, experience and more. Post your job today. The CTO will also be responsible for developing and maintaining relationships with vendors, partners, and customers. This includes developing contracts. The CTO is often in charge of research and development, product engineering, and formulating the technical architecture on which the whole company will be built. The role of a CTO in a startup company is multi-faceted and involves several key tasks and responsibilities such as hiring engineers, developing a. This role will help enable communication, collaboration, strategy execution, and special projects across the CTO organization. The responsibilities include both. A skilled CTO frequently serves as the oracle of technology. They find cutting-edge technological solutions and offer innovative ideas to the business. The chief technology officer (CTO) is the person in a company who deals with innovation and makes effective technology strategies. A CTO is a senior-level “lead technologist” of a company who is responsible for creating, executing and implementing the organization's. We are looking for a Chief Technology Officer (CTO) to provide sound technical leadership in all aspects of our business.

A skilled CTO frequently serves as the oracle of technology. They find cutting-edge technological solutions and offer innovative ideas to the business. The chief technology officer will establish company technology vision, strategies, and plans for growth. They will supervise the system and quality assurance. The Deputy CTO position is Civil Service exempt and serves at the discretion of the Appointing Authority. Primary Duties: · Develop and manage a team of. A CTO is someone who focuses on the scientific and technological operations of a business from an executive-level position. Chief Technical Officer Job Description: What Does a CTO Do? · Manages a company's technology teams, supervising managers, setting goals for departments, and. As a Chief Technology Officer, you have to develop and design technical solutions to achieve our business goals. Get familiar with the role of a CTO in the sphere of software development. The primary role of these specialists is to make technology-related decisions. CTO roles and responsibilities · Communicate the company's technology strategy to partners, management, investors and employees. · Assist with the recruitment. CTO provides guidance for optimized and reusable cloud infrastructure across public cloud providers and in our own data centers. Free Chief Technology Officer (CTO) Job Description Download. Chief Technology Officer (CTO) responsibilities, tasks, skills and duties include A Bachelor's. Universal CTO Job Description and Related Responsibilities · Managing and maintaining the organisation's technology infrastructure. · Ensuring scalability. CTO (Chief Technology Officer) job description: Job duties and responsibilities · Lead the strategy for technology platforms, partnerships and external. The role of a chief technology officer involves strategic management and execution of technology initiatives within an organization. A primary responsibility of the CTO is the direction and management of software products as they relate to their core tasks. Other practical tasks such as QA. Chief Technology Officer Job Responsibilities and Duties · Collaborates with the executive team in establishing business objectives · Monitors existing. The Chief Technology Officer (CTO) as the driver of modern technologies and digital solutions will provide technical and strategic leadership for the. These roles require strong project management capabilities and excellent leadership skills. What responsibilities are common for Chief Technology Officer jobs? A: The job duties of a chief technology officer, or CTO, involve the management of a company's technology functions. A CTO is an executive. The Chief Technology Officer (CTO) is responsible for the technology infrastructure of a company for organisational growth. A chief technology officer (CTO) is an officer tasked with managing technical operations of an organization. They oversee and supervise research and.

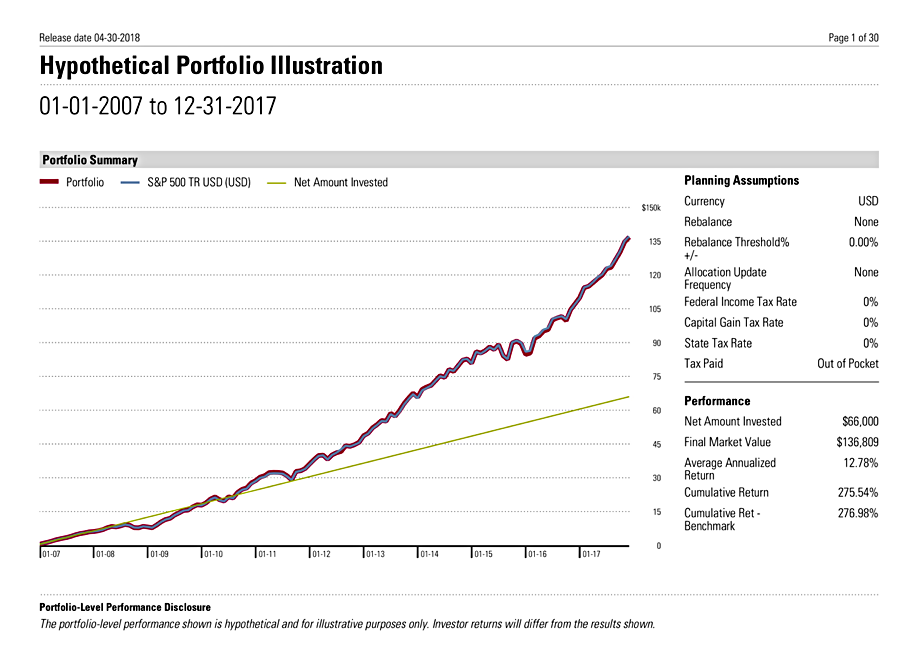

Daily Cost Averaging

Dollar cost averaging is a simple investing strategy that assists in mitigating market timing risk and can help you gradually accumulate wealth. With dollar-cost averaging, you are investing a pre-determined amount every month, regardless of what the price of the underlying asset is. Dollar-cost averaging is a strategy where you invest your money in equal portions, at regular intervals, regardless of which direction the market or a. Dollar cost averaging involves investing fixed amounts regularly, regardless of market conditions. This method averages purchase prices over time. Dollar cost averaging is an investment strategy in which you divide the total amount you'd like to invest into small increments over time, in hopes of. The purpose of dollar-cost averaging is to make investing easier for the average person. Most of us have day jobs and have better things to do with our time. As. Dollar cost averaging (DCA) is an investment strategy that aims to apply value investing principles to regular investment. Dollar-cost averaging is the practice of investing a consistent dollar amount into a given investment regularly. Dollar Cost Averaging works by spreading the total investment across multiple smaller purchases. Instead of investing a lump sum all at once, an investor. Dollar cost averaging is a simple investing strategy that assists in mitigating market timing risk and can help you gradually accumulate wealth. With dollar-cost averaging, you are investing a pre-determined amount every month, regardless of what the price of the underlying asset is. Dollar-cost averaging is a strategy where you invest your money in equal portions, at regular intervals, regardless of which direction the market or a. Dollar cost averaging involves investing fixed amounts regularly, regardless of market conditions. This method averages purchase prices over time. Dollar cost averaging is an investment strategy in which you divide the total amount you'd like to invest into small increments over time, in hopes of. The purpose of dollar-cost averaging is to make investing easier for the average person. Most of us have day jobs and have better things to do with our time. As. Dollar cost averaging (DCA) is an investment strategy that aims to apply value investing principles to regular investment. Dollar-cost averaging is the practice of investing a consistent dollar amount into a given investment regularly. Dollar Cost Averaging works by spreading the total investment across multiple smaller purchases. Instead of investing a lump sum all at once, an investor.

Dollar-cost averaging Plus, many investors prefer a set-and-forget investment style that doesn't require them to follow daily or weekly market moves. Definition: Dollar-cost averaging occurs when someone invests money in equal amounts in periodic installments. Moshe A. Milevsky, Professor of Finance. Dollar-cost averaging involves investing the same amount of money at regular intervals over a certain period of time, regardless of price. Making regular fixed-. Dollar-cost averaging (DCA), also known as the constant dollar plan, is a long-term investment strategy in which an investor divides their planned total. Dollar-cost averaging (DCA) is a strategy where you invest your money in equal portions at regular intervals, regardless of which direction the market or a. Dollar cost averaging (DCA) is an investment strategy in which you invest a set dollar amount on a regular basis, such as every month or every year. At its core, Dollar Cost Averaging (DCA) is a strategic approach to mitigating risks when purchasing stocks or exchange-traded funds (ETFs). It involves buying. Dollar Cost Averaging or DCA is a technique that allows traders and investors to purchase fixed dollar amounts of a specific investment vehicle. Dollar-cost averaging (DCA) is an investment strategy that focuses on regularly investing the same amount of money. To take the emotion out of this decision, many recommend the concept of Dollar-Cost-Averaging (DCA). DCA is an investment strategy in which equal dollar amounts. Dollar cost averaging involves making regular investments of a fixed amount over a period of time. Instead of attempting to time the market, you buy in at a. Similar to a regular savings plan, dollar-cost averaging simply involves investing the same amount of money at set intervals over a long period – whether. Dollar cost averaging works by making more or less the same investment over and over on a repeating basis. For an investor, it may be as simple as investing $5. Dollar cost averaging is an investment strategy in which you divide the total amount you'd like to invest into small increments over time, in hopes of lowering. We work with individual investors just like you every day. And over the years, experience has taught us that time in the market – not timing the market – is. Simply put, dollar cost averaging sees the investor buying a fixed dollar amount of an investment at regular intervals. For me, I take 10% of. The lump- sum investor deployed the entire sum of cash on the first day of the same six-month period. A strategy for all types of markets. Source: RBC GAM. DCA is an investment strategy in which the intention is to minimize the impact of volatility when investing or purchasing a large block of a financial asset or. With dollar cost averaging, it means you'll be investing the same amount each month. When stock prices are higher, you get fewer shares; and when prices drop. Dollar-cost averaging is one way to help smooth out the effect of market fluctuation. It occurs when investors put the same amount of money into their account.